Tick Size in Trading: Definition, How it Works and Why it Matters

Best for copy and crypto trading. Recommendation: APC UPS 1500VA UPS Battery Backup and Surge Protector. All the offers related to MTF are subject to provisions under SEBI circular CIR/MRD/DP/54/2017 dated June 13, 2017. The essential prerequisites for embarking on this journey are minimal: a functional workspace, a handful of computers, and a dedicated team. What are the advantages of intraday trading. Investment apps that offer fractional shares are the best for starting small. Did you know that 90 per cent of individuals who trade leveraged markets end up broke or, at best, break even. By taking a loss early, you can prevent it from becoming crippling to your portfolio. Learn about trading volatility. Bajaj Financial Securities Limited is not a registered Investment Advisory. Doing the actual trading on your phone is fine, I hope you’re using a larger screen to watch data, I’d suggest webull for a data feed, it seems if you’re not trading through a direct to market broker like IBKR to DAS, any broker will do, RobinHood has the easiest platform for phone trading. It’s invisible but essential; it has the power to change the entire course of your life. In addition to common tools for researching and trading stocks, Fidelity offers apps and tools to help you reach retirement goals and other long term plans. You have to place a manual order using the web/mobile application provided by the broker or over https://pocketoption-ir.live/tag/مسابقات-پاکت-آپشن/ a phone call. This method is commonly used by intraday traders when buying and selling commodities. Traders must consider the potential for overnight risks in their risk management strategies. 5 cents per share or $0. These courses emphasize the importance of being careful with money, teaching students how to spread their investments across different areas to reduce the risk of losing a lot of money quickly due to sudden market changes.

App Privacy

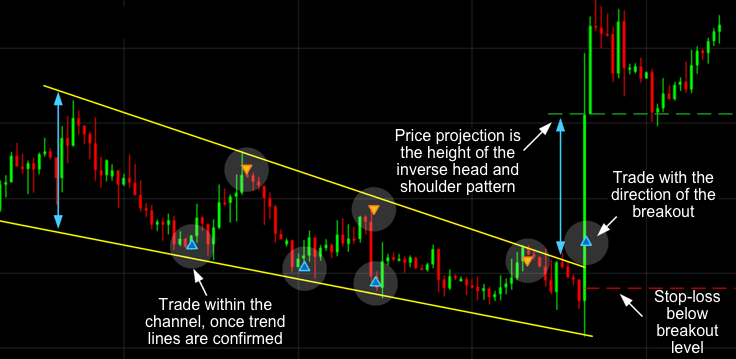

Quantitative traders can employ a vast number of strategies, from the simple to the incredibly complex. Minimum spreads, average spreads, margin rates. You can earn a lot of money and easily manage your daily expenses through this. English, Arabic, Czech, Danish, Dutch, Finnish, French, German, Italian, Norwegian Bokmål, Polish, Portuguese, Romanian, Russian, Simplified Chinese, Spanish, Swedish, Traditional Chinese, Vietnamese. Some of the most popular forex trading styles are scalping, day trading, swing trading and position trading. Probably search « how to trade cheap volatile stocks » or something like that. There are generally three groups of patterns: continuation, reversal, and bilateral. The original online first brokerage boasts an average Apple App Store rating of 4. TRENDING CALCULATORS AND STOCKS ON BAJAJ BROKING. Missing the information I needToo complicatedOut of dateOther.

:max_bytes(150000):strip_icc()/dotdash_Final_Introductio_to_Technical_Analysis_Price_Patterns_Sep_2020-04-9b163938fd4245b0a9cb34d1d0100136.jpg)

You Can Lose Everything and More…

This means you are trading in the moment and not trying to outsmart or predict what the market will do next. A trading account is a nominal account in nature. Day trading is challenging because of its fast paced nature and the complexity of the financial markets. List of Partners vendors. Saxo is our top choice for traders looking for a forex broker with a broad asset range, as it supports over 70,000 different trading products, including stocks, ETFs, options, futures, bonds, commodities, mutual funds, and forex products. Com is provided for general information purposes only. Desmond is incredibly passionate about helping people become better traders working closely with Axi to produce educational videos, quizzes, e books, indicators, and market research to help traders take their game to the next level. Please ensure you understand how this product works and whether you can afford to take the high risk of losing money. Requires significant time and attention: To be successful, intraday traders must constantly monitor the market and be ready to act at a moment’s notice, which can be time consuming and may not be suitable for everyone. The risk of loss would be limited to the premium paid, unlike the possible loss had the stock been bought outright. Investments in securities market are subject to market risks. Please bring an uodate asap. These are some mall games, that predict color analysis to win in the Mantri mall. Commissions may range from a flat rate to a per contract fee based on the amount you trade—both when you buy or sell options. Here’s how you can trade on a mobile trading app. The main premises of scalping are. You must have some basic understanding of the various technical indicators. Another option for investing smaller amounts of money is exchange traded funds. With us, you’d trade using contracts for difference CFDs, a derivative that enables you to speculate on the price movements of an underlying without owning it. As cryptocurrencies are very volatile, lots tend to be very small: most are just one unit of the base cryptocurrency. The head and shoulders pattern forms after an uptrend, indicating the weakening buying pressure and that the sellers soon take control of the market. Commission Delegated Regulation EU 2016/522.

Bullish Options Strategies

Technical analysis plays a crucial role in options trading, and the best part is that the author has combined his study with this analysis. Another good way to combat this possibility is to create and follow a strict risk management plan, specifically one that places limits on the size of positions you take while trading. Now that you know about the best indicators for intraday, let’s cover some tips about intraday trading. A news trading strategy involves trading based on news and market expectations, both before and following news releases. Disclaimer:The material whether or not it states any opinions is for general information purposes only, and does not take into account your personal circumstances or objectives. 0 pips during peak trading hours, with transparent commission based pricing. Please note that the availability of the products and services on the Crypto. A ‘bullish reversal’ indicates that the market is at the bottom of a downtrend and will soon turn into an uptrend. If the trader wants to protect the investment against any drop in price, they can buy 10 at the money ATM put options at a strike price of $44 for $1. Your investing decisions will play a far bigger part than the risk of fraud or theft in determining whether your portfolio is safe. We cannot process your enquiry without contacting you, please tick to confirm your consent to us for contacting you about your enquiry. Sadly what started as a great little app has now become a total mess following a shift to Tradinview for charts. Trading is more than a buzzword or an ’80s throwback. Intraday trading has the potential to fetch higher returns than traditional investment options. AI can help with tasks such as scanning for opportunities, executing trades, and providing insights to inform investment decisions. The color of a candlestick body indicates a bullish or https://pocketoption-ir.live/ bearish price movement. First online related trading activity and rapid growth of electronic commerce started in 1997–98. Insights gathered from these calls helped steer our testing efforts to ensure every feature and tool was assessed. However, what may work against a day trader is the frequent costs of trading, which the trader must take into account while evaluating intraday trading as a business. Pre qualified offers are not binding. So, the target is roughly 10% higher than the initial low of the Double Bottom Pattern chart. This essentially can provide traders with more trading opportunities. Thereafter, all that remains to be done is to create a trading plan and open a live account. In many cases the chart is clearer and helps you to apply technical analysis tools. XBID partners include the EPEX SPOT, GME, Nord Pool, and OMIE power exchanges and the transmission system operators of the participating countries.

Table of content

To take advantage of market changes and seize profitable chances, traders must be aware of these differences in commodities trading time. A score of 20 or under shows oversold market conditions, which is a buy signal. Don’t let a solid profitable trade turn into a loser. Additionally, Pepperstone offers several advanced risk management tools. 15 maximum brokerages payable per order. Because of the ultra narrow time frame, day traders often aim to capture smaller gains more frequently—unless they’re trading a major news event or economic release, which can cause an asset to skyrocket or nosedive. « M » and « W » patterns see Figure 3. Mercedes Barba is a seasoned editorial leader and video producer, with an Emmy nomination to her credit. With OEICs new shares are issued when someone purchases them, rather than having a fixed number of shares. This book is over 1,000 pages long and covers some trading strategies and which type of market they work the best in. It ensures frictionless entries and exits that avoid the dreaded slippage that can be the difference in a positive or negative profit/loss over time. IG International Limited is part of the IG Group and its ultimate parent company is IG Group Holdings Plc. The height of a candle shows the price range of trades, making it easy for traders to understand how much the price is moving. Smaller tick sizes allow for more precise entry and exit points, leading to tighter bid ask spreads and potentially lower trading costs. A stochastic oscillator usually works across the last 14 day trading window, comparing the latest closing price of an asset with the trading range during the last fortnight. Depending on where you are in your crypto journey, you may be interested in different features. Many people have downloaded its latest version, and everyone has described it as attractive. For instance, in the futures market, the E mini SandP 500 futures contract has a tick size of $0. If you have a low risk tolerance or you’re uncomfortable with the idea of substantial losses, leverage trading may not be suitable for you. More ways to contact Schwab. No minimum to open a Vanguard account, but minimum $1,000 deposit to invest in many retirement funds; robo advisor Vanguard Digital Advisor® requires minimum $100 to enroll. A graduate of Northwestern University’s Medill School of Journalism, Nathan spends his spare time volunteering for civic causes, writing and podcasting for fun, adoring his wife, and wrangling his two very large young children.

Paperwork:

Finally, you should avoid the mistake of not doing a multi timeframe analysis. Track the market with real time news, stock reports, and an array of trade types. Account opening charges. It is a good place for people of all levels. The key here is to decide on which factors are most important to you and then create a checklist that will show you whether a stock qualifies or not. The investor creates a straddle by purchasing both a $5 put option and a $5 call option at a $100 strike price which expires on Jan. Yes, anyone can trade futures. Platforms like Robinhood and Webull offer a relatively limited range of cryptos. The Certificate in Quantitative Finance CQF comprises six modules covering the mathematical foundations, financial expertise, Python programming skills, and knowledge of machine learning that are necessary for success in the financial industry. Featured Partner Offers. Computing the net income for the period. Traders should ensure their broker remains FCA regulated and be prepared for potential market fluctuations. So, when entering a swing trade, you often must determine why you’re buying or selling at a specific price, why a certain level of loss might signal an invalid trade, why price might reach a specific target, and why you think price might reach your target within a specific period of time. Understanding how candlesticks form and what information they hold is essential in mastering candlestick patterns. Please see our General Disclaimers for more information. Steenbarger, published in the Journal of Futures Markets, the hammer candlestick pattern has a success rate of approximately 62% in predicting bullish reversals. Use limited data to select content. Missing one of the legs of the trade and subsequently having to open it at a worse price is called ‘execution risk’ or more specifically ‘leg in and leg out risk’.

STATE BOARDS

It would help if you clearly understood the reason behind the application of W and M pattern trading, even though the importance of this pattern trading is essential to all technical traders. Past profits do not guarantee future profits. Both have their advantages and disadvantages, and the best choice varies based on the individual since neither is inherently better. It is crucial to remember that the trading hours mentioned are subject to change and may vary depending on specific exchanges and regional holidays. The reverse is also true. It involves the buying and selling of options contracts, which give the holder the right, but not the obligation, to buy or sell the underlying asset at a predetermined price within a specified time period. For beginners, forming an initial base of knowledge might help safeguard you from trading and investing mistakes that can cost you real money. Use limited data to select content. This is however the wild west with scams all over the place so looking to move into more legitimate stocks etc. Some crypto enthusiasts object to centralized exchanges because they go against the decentralized ethos of cryptocurrency. « Trading Systems and Methods, » Pages 681 733. Your dedicated Tiranga teacher is also available to guide you and help you maximize your profits. Create profiles to personalise content. To find out how much money was invested or incurred by a business. Another advantage associated with scalping is that it demands relatively lesser knowledge about the underlying asset. Options get their value from two sources.

Rank 4 5 / 5 0

Furthermore, there is no trading cap. Plus500 Trading Platform. Meld u aan en voeg u vandaag nog bij 530. While these strategies are fairly straightforward, they can make a trader a lot of money — but they aren’t risk free. For them, I have an article comparing the best Swiss brokers. However, taking advice from an expert helps beginners make the right trading decision. An OTF can also only be operated by an investment firm, while an MTF can be run by an investment firm or market operator. USD 1 fee per options contract is capped at USD 10 per leg, and there are no fees on closing the options. There are two lines on the stochastic oscillator: the black indicator and the red dotted signal. Price action trading is the same across all markets, even forex trading. Call +44 20 7633 5430, or email sales. It has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. This allows a trader to experiment and try any trading concept. However, it’s your responsibility to ensure your account has sufficient funds. Based brokerage firms are safe against theft and broker insolvency. In other words, for a $1,000 deposit, an investor can trade $100,000 in a particular currency pair. Understand audiences through statistics or combinations of data from different sources. Although the types of assets on which U. See how we rate products and services to help you make smart decisions with your money. Therefore, any accounts claiming to represent IG International on Line are unauthorized and should be considered as fake. Past performance is not necessarily a guide to future performance. This stock trading app lets you trade fractional shares and much more. While some day traders might exchange dozens of different securities in a day, others stick to just a few — and get to know those well. At expiration, you either make a predefined profit or you lose the money you paid to open the trade.

About NSE

Exclusive offers, they cannot pay to alter our recommendations, advice, ratings, or any other content throughout the site. All digital asset transactions occur on the Paxos Trust Company exchange. Consult a qualified financial advisor before making investment decisions. Once that is done, choose one of the provided templates or set up the bot’s parameters from scratch. Out of these three criteria, the third one is the one that requires the most research. The login credentials have been sent to your e mail. This is called a « 100 tick chart. For example, if you own shares in companies on the US Tech 100 and are concerned about their value dropping, you could short a US Tech 100 index future – the profits from which would hopefully offset a proportion of your share position losses. They try to take advantage of short term events at the company or in the market to turn a short term profit. Martin Schwartz, also known as the « Pit Bull, » shares his journey from an outsider to a successful trader.