How to Learn Trading: 10 Easy Tips for Beginners 2023

Based on client’s request the funds’ release request must be placed with the Clearing Corporation. The profitability of day trading depends on several factors, including the trader’s skill, strategy, and the amount of capital they can invest. The distribution of this report in certain jurisdictions may be restricted by law, and persons in whose possession this report comes, should observe, any such restrictions. There won’t be a charge for how much leverage you use – whether 5x or 20x your deposit amount. This process helps traders identify any flaws or areas of improvement while fine tuning their approach. Options and futures are two varieties of financial derivatives investors can use to speculate on market price changes or to hedge risk. The downside on a long put is capped at the premium paid, $100 here. Gross Profit is shown on the debit side. Moving Average Convergence Divergence MACD is a trend following momentum indicator. 17R 1b or either or both of the limits imposed in BIPRU 1. These books provide insights into different trading strategies and the mindset of successful traders. They involve high risk and high rewards. All subsidiary companies are represented under the Capital International Group brand. The desktop version of the platform, while offering more features, does have a learning curve. Its downloadable trading platform, thinkorswim, is pretty robust and allows users to paper trade the market.

How to Choose a Cryptocurrency Exchange

Through insightful interviews, Schwager uncovers the diverse trading strategies and approaches that propelled these individuals to market wizardry. For less experienced investors who depend on a fast and reliable platform for managing critical banking features, including managing cash, transferring money, depositing checks, and paying bills, ETRADE Mobile is a solid choice. Trademetria Alternative. 144, 233 are frequently used, but traders are encouraged to find the tick basis that aligns optimally with their trading strategy. Please note that we have not engaged any third parties to render any investment advisory services on our behalf nor are we providing any stock recommendations/tips/research report/advisory. Industry leading educational content. Merrill Edge is a full service broker that offers high quality tools for traders while still catering to investors looking to get started. 43g50825 Cologne/Germany. To talk about opening a trading account. The foreign exchange market works through financial institutions and operates on several levels. These levels measure how much of an earlier movement the price has retraced and use percentages of 23. Where Vanguard really shines is in its mutual funds. The scheme margin is subject to change. Just because an investment has followed an identifiable pattern in the past doesn’t mean it will continue to in the future. When you are facing a losing trade, you should face reality and not just seek proof that you are right and the market is moving in the wrong direction. Plus500 is well known for its CFD trading platform, which provides access to various asset classes, including forex. Here are just a few more reasons to trade with us. The stock market generally follows its holiday schedule without any additional early closures, with the exception of the day before Independence Day, Black Friday and Christmas Eve, when the Nasdaq and NYSE close at 1 p. TRINKER is India’s top virtual trading app, offering a seamless interface that’s perfect for beginners. Low trading and non trading fees. In particular, students will learn how to identify market trends and understand things like business cycles and short term and long term investment strategies. Power ETRADE hits the sweet spot for beginning to intermediate traders. Complete your all in one KYC process. While one broker may give you the opportunity to trade in equity and derivatives, another may provide you with the entire gamut from government securities, debt securities, mutual funds, bonds and more. CFDs are complex instruments.

Public

That’s why we created IG Academy, a self learning hub on our platform, full of interactive online courses, webinars, and live sessions with our resident experts. The decision to invest shall be the sole responsibility of the Client and shall not hold Bajaj Financial Securities Limited, its employees and associates responsible for any losses, damages of any type whatsoever. Day trading for Beginner: Open a trading account, research stocks and grasp market fundamentals for successful trading. It’s another to actually know how to read a chart. If you don’t set stops, you could be placed on margin call and your positions might be closed out automatically. Start building your wealth today. Some offer educational articles, online tutorials and in person seminars. While the W pattern can be a powerful trading tool, it’s not foolproof. For more information on chart patterns, check out many of the resources here at TradingSim. It also offers you the latest market tested tools that can improve your portfolio’s https://pockete-option.website/skachat-pocket-option/ earning potential while limiting its downside risk irrespective of the market performance. In this context, the entities are investors/traders who are exchanging stocks of different companies. Choose the right trading platform: One of many prudent intraday trading tricks involves choosing the right trading platform with all the tools you need to make the right decisions. Client is requested to independently evaluate and/or consult their professional advisors before arriving at any conclusion to make any investment. That being said, it is important to know the ‘best’ chart pattern for your particular market, as using the wrong one or not knowing which one to use may cause you to miss out on an opportunity to profit. It is not easy to find a good trading app nowadays. Zero brokerage up to INR 500 for the first 30 days after onboarding. Before you fly back home, you stop by the currency exchange booth to exchange the yen that you miraculously have remaining Tokyo is expensive. One such step taken was to incorporate tick trading into our investment offerings. And if you’re trading on Kraken Pro, fees fall to some of the lowest of any crypto exchange we review. What are some investing trends that new investors should be aware of. While it may not be the ‘best’ or most accessible for beginners, it caters to a wide range of experience levels. The third candle is a strong bearish candle which marks the trend change from bullish to bearish. Steven holds a Series III license in the US as a Commodity Trading Advisor CTA. To illustrate, let’s consider a hypothetical scenario. TradeStation offers traders a professional platform with access to trade equities, ETFs, options, futures, and even cryptocurrency.

Market Cap

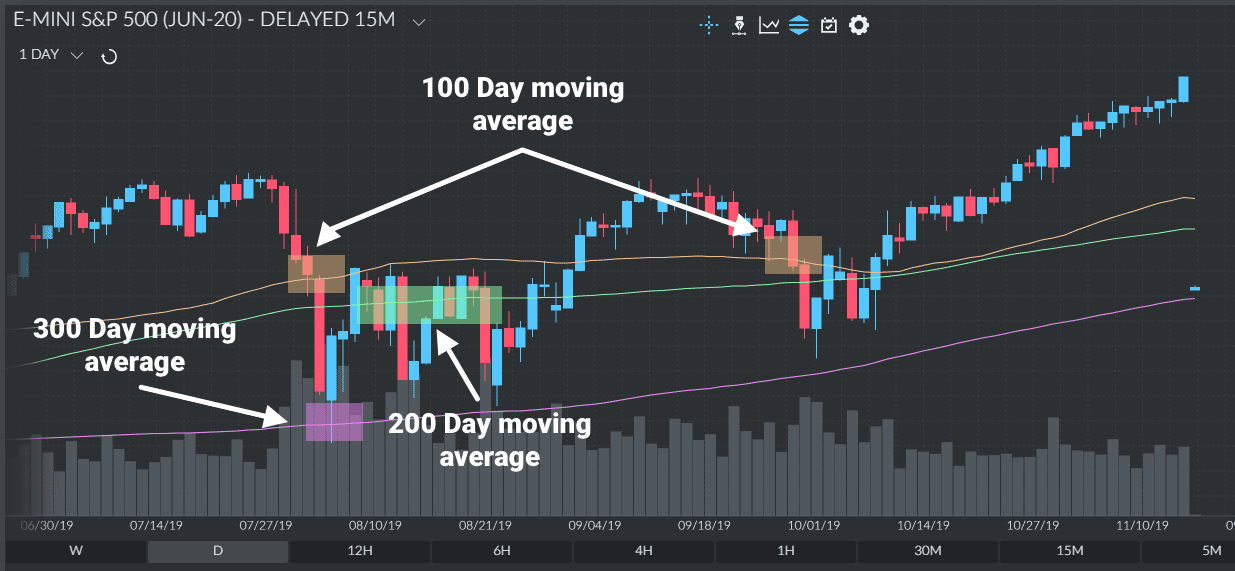

Shorter time frames such as 1 minute, 5 minute, or 15 minute are preferable for intraday trading. I dont know why the program picked me but i start to feel some people are threaten differently than other and this is discrimination. Traders earn profit in a bearish harami pattern by selling the stock at the start of the downtrend and buying the stock at the end after making a profit in the whole trade. You need not undergo the same process again when you approach another intermediary. It’s low cost too commission free, and the customer service is excellent. 6% are believed to reveal possible reversal levels. It involves cultivating a strong mindset that can withstand the emotional ups and downs that come with trading. Noise reduction: By focusing on the trading process, tick charts screen out low volume intervals, eradicating pointless market noise and therefore facilitating far more precise identification of trends. No, scalp trading is not illegal. Take your trading strategy to the next level with JustTicks’ Synthetic Future Analyser. 100% Safe and Secure. In terms of fees, you will initially pay a commission of 0. Grasp short covering and its role in mitigating losses for short sellers.

Buying Index Calls

The primary drawback of this book is Cohen uses the pages to pretty liberally advertise his services at times. Rather than owning the actual stock, you have the right to buy or sell it at an agreed price on a specific date. For entries, take your position on the breakdown, risking the highs. Compare your performance with how you did when paper trading the strategy. Intraday trading requires a high level of discipline to navigate the fast paced stock market successfully. First we need to cover a couple more things. But when selling call options your risk is potentially unlimited. So if you purchase a standard American call option with a 0. Head and Shoulders Pattern. Back to course information. Required fields are marked. Fixed income and mutual fund investing not available. The Charles Schwab Corporation provides a full range of brokerage, banking and financial advisory services through its operating subsidiaries. Of the Discussion Paper’s proposals for modernizing the insider trading provisions, the one most widely discussed before the Committee was that dealing with the time for filing insider trading reports. A quality wedge should be observed to avoid manipulation. Numerous investors will try to enter a long situation at the subsequent low. Here’s how we make money. Moreover, their reliance on cash transactions further places them beyond the scope of the established banking framework. If your investment app charges you a fee a month after opening an account, you may have been charged a monthly maintenance fee.

Investment vehicles

The risk to the buyer of an option is limited to the premium paid upfront. After having placed over 2,000 trades in his late teens and early 20s, he became one of the first in digital media to review online brokerages. Forbes Advisor adheres to strict editorial integrity standards. Set stop loss levels for every trade and ensure that your position sizes are appropriate for your risk tolerance. There are generally three groups of patterns: continuation, reversal, and bilateral. Intraday trading is a short term trading activity that involves buying and selling stocks on the same trading day. Basic Steel Products Trading. Marketing partnerships. Lowest Brokerage Trading and Demat Account. Examples of such options include Nifty options, Bank Nifty options, etc. What do you value most in a forex broker. However, users should be aware of the potential risks and fees associated with investing through these apps and should carefully evaluate the app’s features, fees and security measures before investing. This strategy requires quick decision making and the ability to manage risk effectively, as high volatility can lead to substantial gains or losses. This intraday trading strategy involves finding the stocks that have broken out of the territory in which they usually trade. Swing trades will only be exited when a profit target is reached, or the position is stopped out. A spot market deal is for immediate delivery, which is defined as two business days for most currency pairs. Stockbrokers provide you an option to open a demat and trading account. Short term trading is a recent phenomenon, which emerged in the late 20th century as computerized trading terminals and data networks spread beyond the cadre of professional traders in places such as New York, Chicago, and London. Best research for beginners. Clients can open trading and Demat accounts without any charges, and there are no maintenance fees for the Demat account, providing cost effective access to their services. And, they can buy shares back to reduce the number of shares in circulation, which increases the price of existing shares. Available fractional share investing. Be aware of any fees or commissions associated with your trades because these can affect your profits. These may be utilised on iOS and Android platforms, giving consumers access to their software at any location or device. If you’re new to investing or prefer a hands off approach, this type of trading may feel overwhelming. A rectangle chart pattern can be witnessed when the stock price movement is within a consistent price range. You could effectively use a call option contract to buy that stock at a discount, saving yourself $4,700 $50 x $100, minus the $3 per share premium.

Ascending Triangle Pattern

COGS stands for the cost of goods sold. Options trading offers several advantages, including. These time frames help traders capitalize on small price movements, crucial for intraday trading. You can lose your money rapidly due to leverage. John Paulson, a hedge fund manager in New York, led his firm to make $20 billion in profits between 2007 and early 2009. Traders make bets on Stock prices, but these bets are not done through the official stock market. Bajaj Financial Securities Limited is engaged in the business of Stock Broking and as a Depository Participant. Entering an amount of shares on any setup or signal from your system and closing the position as soon as the first exit signal is generated near the 1:1 risk/reward ratio. If you can pinpoint a share of stock that is in an obvious uptrend, you can potentially purchase those shares and benefit from the upward price movement. This trading book is popular because Schwartz’s candid account details both his killer instincts, and his mistakes. $0 for stocks, $0 for options https://pockete-option.website/ contracts. Watch the statistics speak for themselves. These types of strategies are designed using a methodology that includes backtesting, forward testing and live testing.

SpiceJet eyes fundraising

Thus, any claim or dispute relating to such investment or enforcement of any agreement/contract /claim will not be under laws and regulations of the recognized stock exchanges and investor protection under Indian Securities Law. Using a tick chart allows you only to make trades after a certain amount of market activity has already happened. Discover why so many clients choose us, and what makes us a world leading provider of CFDs. Looking for the best day trading books to kickstart your journey. A scalper could deploy the same or different technical indicators to a standard technical trader while performing trades. Investors are generally long term, buy and hold market participants. For call options, that means the cost associated with doing so in other words, the money to buy 100 shares of the underlying stock will be due at that time. How to Make Money in Intraday Trading – by Ashwani Gujral. Also, your new client friend will receive $1 in IBKR stock for every $100 of value they add to their account. Performance based on real fills. With some trading apps, you can also trade currencies, such as Pounds GBP and Dollars USD. NVIDIA’s dominance in graphics processing units has fueled this massive rally, and its products are a crucial component for everything from gaming consoles to AI servers. State whether the following statement is True or False with reasons. Below mentioned are the Indian stock market holidays that are falling on Saturday/Sunday. You can read posts from fellow individual investors and dip a toe into the world of copy trading. Fortunately, no coding is required to leverage this algo trading software. US Stock and ETFs since 1998, managing corporate actions, from tick to daily resolutions. While there are those who specialize in contrarian plays, most traders look for equities that move in correlation with their sector and index group. But remember: Live trading is different emotionally, so there will be a learning curve when you start trading with real cash. Plan, strategise, and automate your trades with uTrade Algos’ no code algo trading platform. Founded in 1973, the CBOE is the first options exchange in the United States. But it’s exploded in the internet age, where resourceful traders can find deals on one website then flip the same product for a lot more on another website. Corporate Office: Bajaj Financial Securities Limited, 1st Floor, Mantri IT Park, Tower B, Unit No 9 and 10, Viman Nagar, Pune, Maharashtra 411014. Noise traders tend to trade impulsively based on short term market fluctuations and random price movements. A news trading strategy involves trading based on news and market expectations, both before and following news releases. This means you either have to already own crypto or use a centralized exchange to get crypto that you then use on a DEX.

FOLLOW US

The platform does not have any editorial control over the products sold, nor does it evaluate the technical references and experience of those who create them. However, users have reported occasional app lag during high traffic periods, and the account maintenance charges are higher than some competitors. Learning how to successfully and consistently navigate the stock market is a personal journey. Traditional stock brokers often work for corporations and may earn commissions on the products they sell you they are salespeople, and that may affect their advice. There were no instances of non compliance by Bajaj Financial Securities Limited on any matter related to the capital markets, resulting in significant and material disciplinary action during the last three years. However, if you make a wrong bet, you could lose your whole investment in weeks or months. 3 Non Current Liabilities. Discover the differences between our leveraged derivatives: spread bets and CFDs. John Bringans is the Senior Editor of ForexBrokers. « In investing, what is comfortable is rarely profitable. » Ready to get started.

Get to know us

A breakaway gap occurs when the price of an asset breaks through a support or resistance level and continues to move in the same direction. To learn more about our rating and review methodology and editorial process, check out our guide on how Forbes Advisor rates investing products. The most crucial thing is to keep a close eye on the fluctuating value of various assets. Use profiles to select personalised advertising. 1 pick in our ranking of the best robo advisors for everyday investors. International investment is not supervised by any regulatory body in India. Modus operandi of Dabba trading operators. Before opening any attachments, please check them for viruses and defects. I have literally read hundreds of trading books. The Discussion Paper recommended that these provisions be maintained and amended. The information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any specific investor, and might not be suitable for all investors. Scalping generates heavy commissions due to the high number of transactions. A brokerage account is a type of account similar in function to the accounts you have with a bank. Brokers, market makers, banks, hedge funds and asset managers can connect to MTFs directly – becoming ‘members’ – while retail traders can only access the markets on offer via a provider of their choosing. What to look out for: The investment platform’s website can be tricky. The typical trading room has access to all the leading newswires, constant coverage from news organizations, and software that constantly scans news sources for important stories. Many traders see their margin wiped out incredibly quickly because of a leverage that is too high. The university houses more than 70,000 students and is one of the largest universities in Scandinavia. Knowledge Center Fundamental Analysis. You should make trades based on your plan if your trading plan relies on technical analysis. What Is Intraday Trading 5 Key Rules You Must Know. While positional trading has many advantages, it also has potential downsides. A modest trader regards the market as an authoritative educator, honors its teachings, and acknowledges that achievement stems from perpetual education and receptivity to critique, rather than deluding oneself into thinking they possess complete understanding. Conversely, the right time to buy a stock is when the price is low. When I’m trusting my money potentially large amounts to a company I want to know there is someone who’s going to help if there’s a problem. Allow analytics tracking. For the second time this year, the Indian stock exchanges will conduct a special live trading session on Saturday in a bid to switch over to a disaster recovery site. Your full time attendance is required Monday through Friday between the hours of 9:00 am and 3:30 pm for intraday trading.